- Jason Bond Picks

- Posts

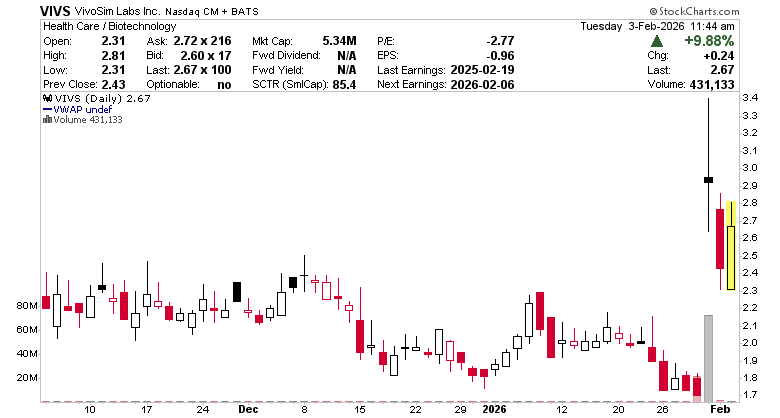

- VIVS trade plan

VIVS trade plan

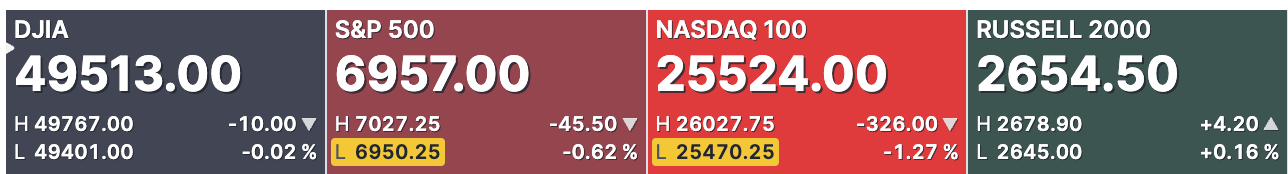

Tech sinks while small-caps head higher

Good morning — Jason Bond here.

The small-cap rally is just getting started.

Pretty big drop in tech today but as you can see, the IWM (Russel 2000) is diverging from tech.

I think looking at VIVS for a fibonacci retracement or rest and retest of the highs is worth out time.

Trade plan:

Entry: $2.60-$2.80

Target 1: $3.00

Target 2: $3.40

Target 3: Breakout on the rest and retest of the high

Stop loss: $2.50-$2.40’s

Big volume collected short sellers and now it’s reversing putting pressure on the offer.

If this gets over $3 I think that it’ll gain momentum and volume again.

Stop by the chat room (FREE) for real-time trade alerts and stock talk.

CLICK HERE » https://discord.gg/ExBpUE82 «

Eat. Sleep. & Trade!

Jason Bond

Questions or concerns about our products? Email [email protected]

© Copyright 2025, Jason Bond LLC

*DISCLAIMER: This entity is owned by Jason Bond LLC (JB). To more fully understand any JB subscription, website, application or other service, please review our full disclaimer located at https://www.jasonbondpicks.com/disclaimer.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any JB Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. JB strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. Jason Bond LLC Services may contain information regarding the historical trading performance of JB owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers' trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

Jason Bond LLC IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither JB nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor(IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

WE MAY HOLD SECURITIES DISCUSSED. JB, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.

*AFFILIATE LINKS: If you purchase anything through a link in this email other than RB services, we earn a commission from the company providing that product. RB has affiliate relationships with these companies and receives compensation when you make purchases through our links. We recommend that you do your own independent research before purchasing anything. RB is not responsible for any content hosted on affiliate sites and it is the affiliate's responsibility to ensure compliance with applicable laws.

Jason Bond LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with Jason Bond LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, JB shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.