- Jason Bond Picks

- Posts

- READ NOW: Is this $2 stock about to crash?

READ NOW: Is this $2 stock about to crash?

Understanding the baby shelf rule

Good afternoon,

Most small-cap stocks depend on dilution to stock pile cash.

This is because they are not profitable.

Stocks have an IPO which raises a lot of money.

But when they run out of that cash, they raise more.

The process of raising capital after the initial IPO is called a ‘secondary’ offering.

And it’s done through what’s called a shelf.

Think of it this way, a company has a lot of shares, ready to sell, on a shelf.

If they pull them off the shelf and price them, those shares dilute the share structure and the stock often falls to the price of the secondary offering.

How can we use this information to make informed decisions when trading small-cap stocks?

We might want to avoid holding overnight if we think a company will dilute through a secondary offering

We might want to get short (bet against) the price if we think it could drop due to dilution i.e. secondary offering

Let’s use a real world example from this week:

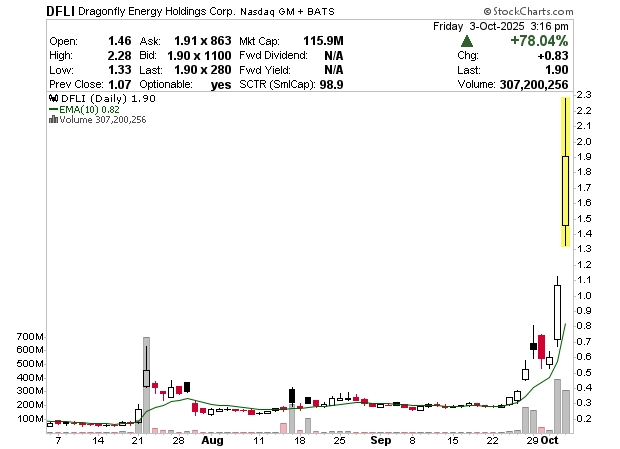

DFLI is up a lot based on a $300,000 award they are likely to get.

DFLI is low on cash. The company has 2.8 months of cash left based on quarterly cash burn of -$3.93M and estimated current cash of $3.7M.

DFLI has a shelf in place.

What’s interesting on this trade is they have what’s called a ‘baby shelf restriction’ that looks like it’ll be unrestricted after the close today.

We know a shelf is a bunch of shares, on a ‘shelf’ waiting to be taken off and sold into the market.

But what’s a ‘baby shelf’ you ask?

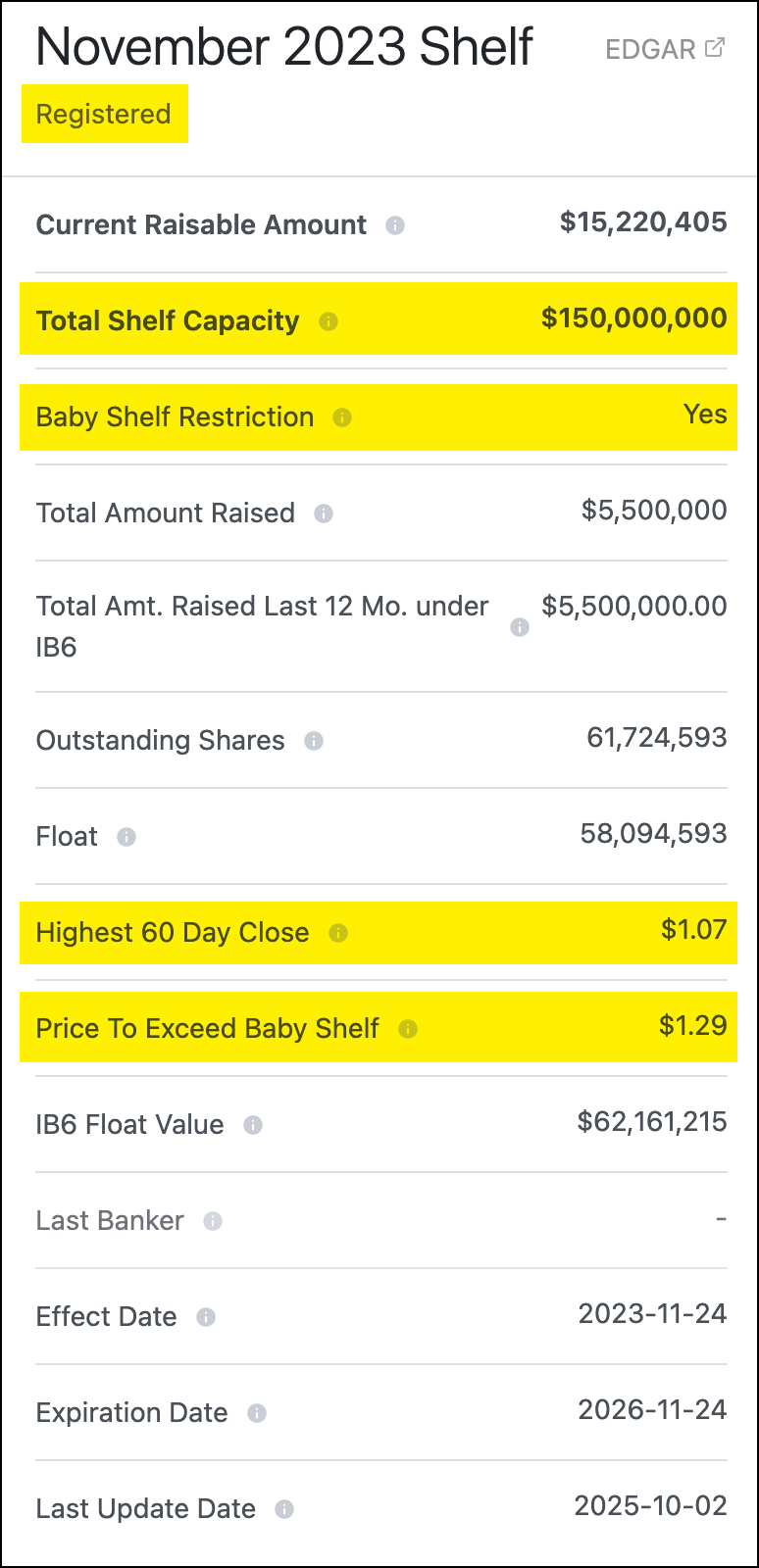

DFLI has the ability to raise $150M. Since they already raised $5.5M let’s call it $145M on the shelf.

The problem for DFLI is there’s a baby shelf restriction.

As you can see above they need to close the stock above $1.29 to ‘UNLOCK’ the full dilutive capacity.

This isn’t to say they will, but since it looks like the price will close above $1.29, there’s added risk the company will dilute — make sense?

Price to exceed baby shelf = $1.29.

Definition: The price that the stock needs to close above to be no longer restricted by baby shelf, which may allow the company to raise more funds through the shelf.

As a teachable moment I’ll take DFLI short into the after hours to see if the company acts on this.

Sometimes companies try to announce bad news on a Friday night (dilution is bad) hoping traders aren’t around to see or act on it.

With the stock price up from $.30’s to $2’s in a few weeks and the baby shelf of $150M unlocked (assuming a $1.29+ close) then risk goes up for longs.

To short is to bet against price, which of course is risky, but in this sense it makes cents I believe.

I encourages you to learn from this and watch across the coming days to see what happens to the price of DFLI stock.

I like this company, I’ve traded it long. And I like seeing companies go up in price.

However, I’m also about teaching trading and when it makes sense to share something with you that you can use going forward, I’ll do that.

Have a great weekend, I’ll be in touch. And again, watch the following:

Does the price close above $1.29

Does the company raise money and if so, at what price (usually lower)

What happens to the stock from here

Talk soon — Jason Bond

Questions or concerns about our products? Email [email protected]

© Copyright 2022, RagingBull

DISCLAIMER: To more fully understand any Ragingbull.com, LLC ("RagingBull") subscription, website, application or other service ("Services"), please review our full disclaimer located at https://ragingbull.com/disclaimer.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers' trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor(IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers mentioned in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.

*Sponsored Content: If you purchase anything through a link in this email other than RagingBull (RB) services, you should assume that we have an affiliate relationship with the company providing the product that you purchase, and that we will be paid in some way. RB is not responsible for any content hosted on affiliate’s sites and it is the affiliate’s responsibility to ensure compliance with applicable laws. We recommend that you do your own independent research before purchasing anything. While we believe in the companies we form affiliate relationships with, please don’t spend any money on these products unless you believe they will help you achieve your goals.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

If you have a current active subscription with Jason Bond Picks you will need to contact us here if you want to cancel your subscription. Opting out of emails does not remove you from your service at JasonBondPicks.com.