- Jason Bond Picks

- Posts

- "GAME" time!

"GAME" time!

Why Smart Money Is Stacking This Crypto Yield Stock 💰

*together with TradingPub

ATTN: 11:30am ET.

Legendary Trader Lance Ippolito Joins Me For:

The Probability-Based Strategy You’re Missing Now

4PM Payout Plan!

ISSUER-SPONSORED CONTENT BY GAMESQUARE*

Good morning — Jason Bond here.

Wednesday morning’s email (below), asked you to take a look at GAME.

Today’s it’s almost up 10% from premarket yesterday …

… and I think it’s just getting started!

For those who opened their email quickly yesterday, well, so for so good.

And that’s with Ethereum down -3% today.

Remember, they have a buyback program in place under $1.50.

That’s about 100% from here.

No guarantees it’ll get there but …

… there’s a lot of catalysts on this one, but big money is my fav.

If you don’t know the billionaires in the world, you should.

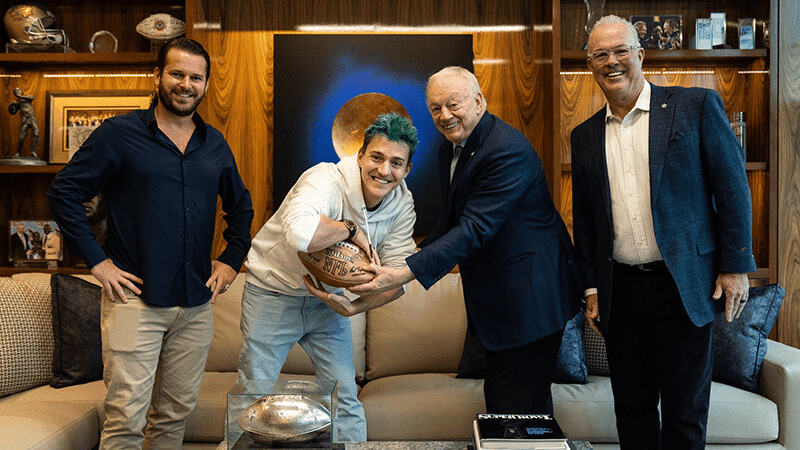

From left to right: GameSquare CEO Justin Kenna, Tyler "Ninja" Blevins, Dallas Cowboys owner Jerry Jones, Cowboys VP Stephen Jones

Below is the email from yesterday.

Take another look because this move could be the tip of the iceberg.

— Jason Bond

Wednesday morning’s email said:

Good morning - Jason Bond here. One of the best catalysts I know for swing trading small-cap stocks under $10 is:

🚀 Follow the Big Money

Here’s the truth about trading:

Most retail traders chase crumbs. They’re late, emotional, and usually wrong.

But the smartest way to stack the odds in your favor?

👉 Follow the Big Money.

I’m talking about institutions, hedge funds, billionaires—the whales that move markets. When they take a position, they don’t drop a few grand. They slam millions—sometimes billions—into a single trade.

And when that tidal wave of capital hits a small-cap stock? 💥 That’s when you get explosive moves.

📈 Spikes that go 30%, 50%, even 100%+ in DAYS.

🔦 Moves you can see on scanners if you know where to look.

🧠 Predictable patterns that repeat because Big Money doesn’t sneak in quietly—they leave footprints.

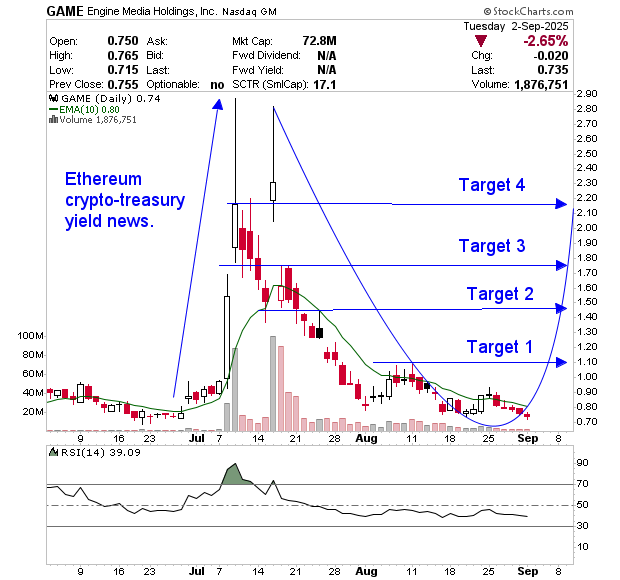

Let’s have a look at NASDAQ:GAME

🔑 Investment Highlights

Great Underlying Business: Diversified media, gaming, and tech operations with strong revenue growth.

Generational Backing: Supported by Dallas Cowboys’ owner Jerry Jones and financier John Goff. Their sons, Tom and Travis Goff, sit on the board—underscoring long-term commitment.

Clear Path to Profitability: Predicting Q3 2025 profitability, driven by leaner operations and crypto yield.

Strong Insider Alignment: 22% insider ownership, signaling conviction from management and backers.

🚀 Catalysts for Growth

Crypto Treasury Strategy

$100M Ethereum treasury expanded to $250M.

Partnership with Swiss firm Dialectic to generate 8–14% yield via ETH staking and NFT strategies.

Dual upside: passive yield + Ethereum price appreciation.

Divestiture of FaZe Media

Eliminated the company’s biggest cash-burn division.

Focus is now on high-margin, scalable businesses.

Share Buyback Program

Up to $5M in stock repurchases under $1.50/share.

Signals management’s belief in 100%+ upside from current levels.

Revenue Acceleration in 2H 2025

60% of annual core revenue expected in the back half of the year.

Tariff-related delays may create an explosive rebound when resolved.

📊 Valuation Snapshot

Market Cap: ~$75M

Analyst Rating: Strong Buy, $3.00 PT (~300% upside)

mNAV: ~$0.80 → For every $0.80 invested, investors are effectively getting $1 of Ethereum holdings.

Stock Price: Trading under $1.00 (Sept 2025).

🏆 Why GAME is Undervalued

Strong core operations + crypto yield strategy = hybrid growth model.

Real business value plus a crypto‑backed balance sheet.

Generational investor base ensures strategic stability.

Buyback and insider ownership show insiders see deep value.

⚡ Bottom Line

GameSquare Holdings (GAME) is positioned as the ultimate small-cap crypto-treasury play: a leaner, revenue‑growing company with high-yield Ethereum assets, insider conviction, and generational support from Jones and Goff families. With profitability on deck and a stock trading well below NAV, GAME represents a rare asymmetric opportunity.

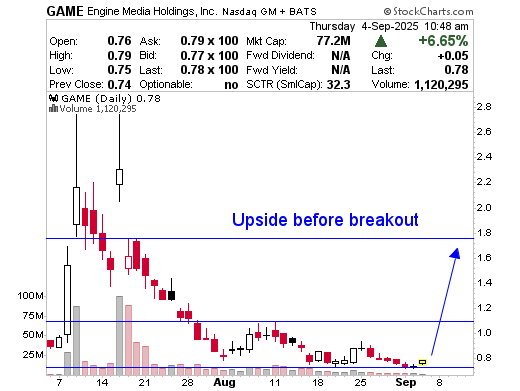

📊 Technical Analysis

Stock currently trades under $1.00, near strong historical support levels.

Chart shows upside potential to $1.50 resistance (aligned with buyback threshold).

Breakout above $1.50 opens range toward analyst target of $3.00, reflecting 300%+ upside.

As a small-cap swing trade, the strategy is to capture 20–30% within the identifiable range while allowing the larger trend to play out.

With excellent support or a triple bottom around $.70, the downside appears limited, though always respect stop losses. And the upside, if it works, could be a great trade.

Jason Bond

Questions or concerns?

Email [email protected]

*DISCLAIMER: This entity is owned by Jason Bond LLC (JB). To more fully understand any JB subscription, website, application or other service, please review our full disclaimer located at https://www.jasonbondpicks.com/disclaimer

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we currently have received two thousand five hundred dollars (cash) by bank transfer by Sherwood Ventures LLC, for advertising for a two day marketing program on September 3, 2025. These amounts were paid to Sherwood Ventures directly from GameSquare. We may also buy or sell shares in the company at some point in the future, although neither JB nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into GameSquare might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear, neither JB nor its owners, employees, or independent contractors are registered as a secur1ties br0ker-dealer, br0ker, 1nvestment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.